Top 6 AR Automation Software in 2026 & How to Implement It

Published on January 5, 2026

TL;DR

- Manual AR teams hit a scalability ceiling around 500-1,000 invoices/month. The bottleneck isn't invoice processing; it's the hundreds of customer emails per week requesting documents, clarifying POs, disputing amounts, and confirming payment dates.

- AR automation in 2026 has shifted from workflow tools to conversation automation. Traditional platforms automate reminders and tasks, but they can't read customer replies, retrieve documents on demand, or capture promise-to-pay commitments hidden in email threads.

- Paraglide is the only platform built to automate high-volume AR conversations at scale, working directly inside your finance inbox, handling 2-way communication in 100+ languages, syncing commitments to your ERP in real time, and escalating only when human judgment is required.

- The impact is measurable: Lowering Days Sales Outstanding (DSO) by just 5 days in a $50M revenue company releases $685K in working capital.

From my experience as a Finance Operational Manager, managing AR teams over the years, the biggest bottleneck is the volume of customer emails, missing documents, PO updates, requests for copies, remittance clarifications, and disputes.

Missing POs, unclear remittances, disputes, and requests for invoice copies flood our inboxes daily. If these messages sit unanswered for even a couple of days, cash gets delayed, DSO creeps up, and forecasting becomes a guessing game.

Even with ERPs, e-invoicing, and dashboards in place, the back-and-forth communication that actually determines when customers pay is still mostly manual. That's why we opted for AR automation, the newest tools that send reminders and act on the conversation layer inside the inbox, like reading messages, responding to routine queries, retrieving documents, capturing commitments, and escalating only when human judgment is required.

This approach allowed my teams to operate consistently instead of reactively. Payments move faster, disputes are resolved sooner, and finance teams can finally focus on strategic priorities instead of just keeping up with inbox traffic.

In this guide, I'll walk through how AR automation software actually works in day-to-day finance operations, how the leading platforms differ, and what teams can realistically automate to lower DSO, speed up cash flow, and reduce manual inbox work.

Hidden Delays in Customer Communications

Inbox is Overloaded: Shared-service teams managing 5000+ invoices often receive thousands of emails monthly. Unanswered messages delay payments by 7-14 days. A missing PO or document triggers 6-8 follow-ups per case.

Manual Workload Risks: Traditional AR struggles with:

- Excessive follow-ups ("Just checking in…" or "Is this the correct PO?")

- Fragmented visibility, causing 15-25% forecast variance

- Delayed dispute resolution, increasing DSO and bad-debt risk

Conversation Layer Bottleneck: 60-80% of payment delays happen in the back-and-forth emails. Customers don't pay because:

- They can't find the invoice

- AP needs backup documentation

- Partial deliveries triggered disputes

- Reminders are missed or ignored

Shift to Conversation Automation: AR tools go beyond reminders and workflows by:

- Sending intelligent, ERP-informed automated reminders

- Automating inbox-level tasks: routing emails, extracting remittances, translating responses, logging promise-to-pay commitments

- Handling disputes: reading emails, 2-way automations, classifying issues, gathering documents, routing, and updating customers automatically

- Prioritizing work: focusing teams on exceptions rather than repetitive tasks

Operational Impact: AI agents, like in Paraglide, allow high-volume teams to reduce delays, enforce consistent credit-control policies across regions, and improve cash forecasting accuracy.

Customer-Centric Communication: AR software emphasizes clear, empathetic interactions, which reduce friction and increase payments. Companies like DHL, HP, and Intel show that faster dispute resolution directly lowers DSO.

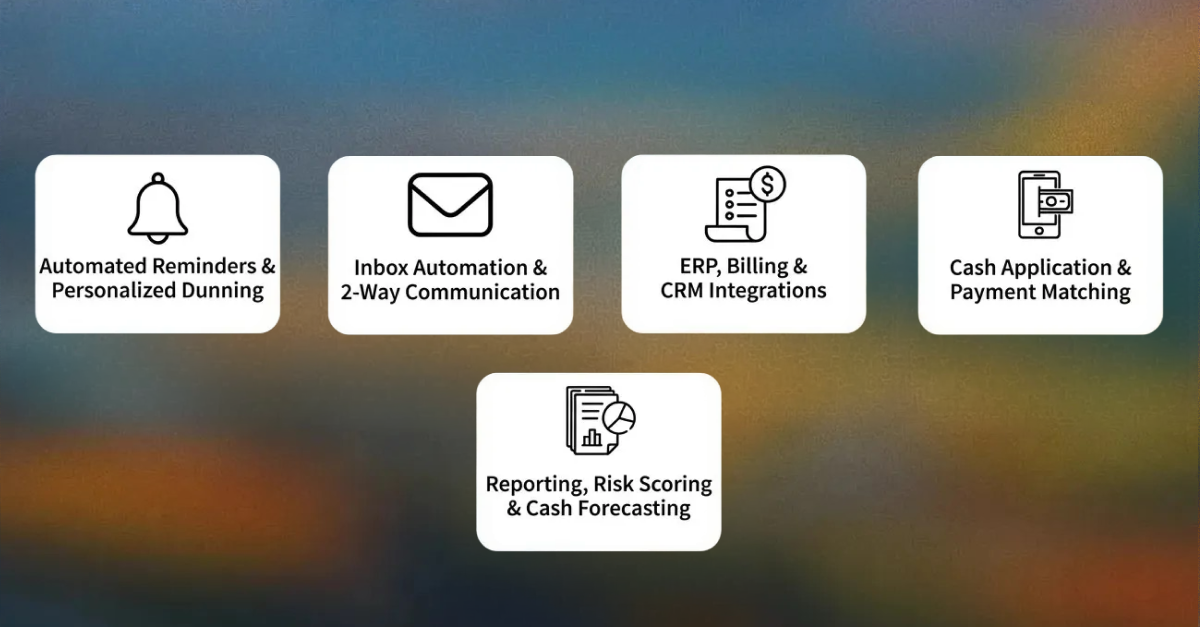

Key Account Receivable Automation Features to Look For

Understanding the key features of some of the best accounts receivable software helps teams compare tools objectively and determine which platforms actually reduce DSO versus those that simply digitize existing workflows.

Below are the capabilities that matter most for AR teams managing high volumes of invoices and customer communication.

Automated Reminders & Personalized Dunning

Most AR automation platforms now give automated reminders, but the depth of personalization varies widely. Traditional systems rely on static sequences, while more advanced solutions adjust tone, timing, and content based on customer behavior and invoice history.

Platforms with AI-driven communication, such as Paraglide, go a step further by customizing messages based on the customer's actual email replies, making follow-ups feel conversational rather than templated.

Inbox Automation & 2-Way Communication

This is where the biggest difference between tools emerges. Many AR platforms automate outbound communication but still require teams to manually handle inbound emails, disputes, clarifications, and document requests. Large shared-service centers operating across APAC, EMEA, and LATAM rely on Paraglide's 100+ language support to eliminate manual translation workflows and ensure consistent customer communication across markets.

Only a few platforms, like Paraglide, built specifically for this layer, with AI agents that manage 2-way conversations directly inside the finance inbox, respond to queries, and escalate only when needed. For teams overloaded with customer emails, this capability is often the primary driver of time savings.

ERP, Billing & CRM Integrations

Strong integration determines how reliably a tool can automate work. Leading platforms sync invoice data, payment status, credit limits, and customer details from systems like NetSuite, SAP, Microsoft Dynamics 365, Sage, QuickBooks, Salesforce, etc.

Mid-market tools focus on faster, lighter connections, while enterprise platforms give multi-entity and multi-currency support. Paraglide also leverages these integrations to ensure AI agents always reply with accurate, real-time data from the ERP, lowering errors and stopping back-and-forth emails with customers.

Cash Application & Payment Matching

Cash application remains one of the most time-consuming parts of AR, especially for teams handling high volumes of ACH, wires, and remittance emails. Many enterprise tools, such as Billtrust or HighRadius, use machine learning to improve match rates and reduce exceptions. Mid-market platforms typically focus on increasing reconciliation through rule-based logic.

Reporting, Risk Scoring & Cash Forecasting

Analytics help AR teams understand where delays occur and which customers require focused attention. Most platforms give standard dashboards for aging, DSO, collector activity, and dispute volume. Early dispute detection reduces bad-debt write-offs by flagging stalled conversations before invoices age past 90 days, allowing credit controllers to intervene proactively.

AI-first platforms like Paraglide add a new dimension: forecasting based on communication patterns, such as promise-to-pay dates, reply speed, or unresolved disputes, signals that often predict cash timing more accurately than aging alone.

How We Evaluated the Top AR Automation Tools

- High-Volume AR Pain: 1,000+ invoices/month → 200-400 emails/week; each unanswered email delays payment 7-14 days. Missing POs create 6–8 follow-ups; >60% of collector time spent on document retrieval.

- Evaluation Focus: Workflow automation, ERP/CRM/Billing integration, true 2-way communication, analytics & forecasting, implementation speed, global readiness.

- Key Insight: Most tools manage workflows; few handle the conversation layer, where 60–80% of delays occur.

- AI Communication: Paraglide operates inside the inbox, managing 2-way conversations across more than 100 languages, retrieving documents, capturing promise-to-pay commitments, flagging risks, and syncing all activity to ERP for auditability and compliance.

- Impact: Faster rollout, fewer communication delays, consistent credit control across subsidiaries, and real operational scalability.

Top 6 AR Automation Software Platforms in 2026

Paraglide: Best for AI-Powered AR automation and Conversation Automation

Paraglide automates the conversation layer of AR, the back-and-forth emails, document requests, and clarifications that cause 60-80% of payment delays but sit outside traditional ERP and workflow systems.

Most AR tools automate workflows and generate tasks for your team to complete, but Paraglide is one of the very few purpose-built platforms to automate the conversational layer and its AI agents operate directly inside the finance inbox, managing the actual conversations that determine when customers pay. It handles 2-way communication in 100+ languages, retrieves documents instantly, captures promise-to-pay commitments, and syncs everything back to your ERP in real time, escalating to humans only when judgment is required.

From my experience managing AR operations across multiple regions and dealing with hundreds of customer emails weekly, requests for invoice copies, PO clarifications, and payment confirmations, manual responses typically take hours or days. However, Paraglide handles these routine queries in under 2 minutes, eliminating the communication delays that push payments into the next cycle.

It also supports multi-region, multi-entity AR operations, keeping consistent credit-control policies while handling market-specific tax details, languages, and documentation needs. Instead of requiring regional specialists to handle routine inbox communication in different languages, using Paraglide helps to manage consistent responses across all markets while keeping your credit control policies.

Paraglide also provides full governance and audit readiness. Every AI-generated response, customer reply, attachment, and promise-to-pay commitment is logged with complete traceability for SOX compliance and internal audit requirements. Its AI agents flag early warning signals to customer silence, recurring disputes, partial payments, or missing documentation. This allows credit controllers to intervene before invoices breach credit-insurance terms or move into write-off territory.

Paraglide is purpose-built for enterprise AR teams managing hundreds and thousands of invoices monthly across regions and business units, especially those looking to reduce DSO without adding headcount.

Versapay: Good for Collaborative AR Workflows

Versapay is built around a collaborative AR portal that brings AR teams and customers into a shared environment to manage invoices, disputes, and payments. It works well for mid-market organizations with concentrated customer bases, especially those that benefit from structured dispute resolution and a unified view of documents and payment activity.

However, Versapay's collaboration model is portal-centric, not inbox-native. Its effectiveness depends on customers actively logging into the portal, which requires a behavior change from those who default to email for payment questions, disputes, and document requests. This approach can work well when customer adoption is achievable, but it becomes more challenging in high-volume, multi-region environments where inbox traffic remains the dominant channel.

Versapay is therefore well-suited for mid-market teams where portal adoption is realistic, customer bases are manageable, and structured collaboration is a priority, rather than enterprises trying to automate thousands of inbound emails across regions and languages.

Billtrust: Best for Enterprise Invoice-to-Cash Automation

Billtrust provides a consolidated invoice-to-cash platform used primarily by larger enterprises that need standardized workflows across invoicing, payments, cash application, and collections. Its key strength is automating structured, rule-based processes, especially in cash application, where matching rules reduce manual reconciliation effort.

Billtrust is best understood as a workflow automation system and it streamlines invoice delivery, payment processing, and system-to-system updates, but it does not operate inside the communication layer where most payment delays occur. Customer replies, document requests, disputes, and follow-up questions still need to be handled manually by AR teams, because Billtrust does not manage two-way email conversations.

Deployments typically involve longer implementation cycles due to the need to integrate multiple modules across the invoice-to-cash stack. For organizations whose priority is centralizing structured AR workflows, Billtrust gives a stable, process-driven environment.

However, it remains focused on transaction flow rather than the day-to-day communication work that determines payment timing. This makes it suitable for enterprises optimizing system consolidation, but not for teams trying to remove the inbox bottleneck.

HighRadius: Best for Large Enterprise

HighRadius is widely used in global enterprises that require structured, AI-enhanced workflows across credit, collections, and deductions. The platform generates prioritized task lists and automated workflows for AR teams, helping large organizations coordinate high-volume processes in a consistent and repeatable manner.

Its strengths lie in environments that need extensive structure, such as predictive analytics for forecasting, standardized deduction resolution flows, or enterprise-scale task orchestration. These capabilities are valuable when teams manage thousands of transactions and require tight process governance.

However, although HighRadius is also complex because it focuses on workflows but not on conversations or inbox automation. Deployments typically involve significant configuration, process redesign, and extended implementation timelines.

This is because of the platform's depth; teams often invest considerable time in system setup, training, and ongoing change management. Customer replies, clarifications, and exception handling still require manual effort because the system focuses on workflow generation and not on managing two-way email conversations.

Gaviti: Best for Mid-Market Collections Optimization

Gaviti focuses on helping mid-market AR teams manage moderate invoice volume that needs clearer visibility into collection performance and more consistent follow-up processes.

The platform focuses on automated dunning workflows, collector dashboards, and portal-based customer interactions, rather than inbox-level communication. It focuses on workflow orchestration, such as automating reminders, tracking tasks, and providing analytics that help collectors manage open invoices. For companies with straightforward AR processes, this standardized sequence and payment portal provide predictable improvements in follow-up consistency.

However, because Gaviti remains primarily a workflow and sequence automation tool, and not an inbox-native communication platform, it does not automate the actual customer conversations that drive payment timing, such as responding to disputes, retrieving missing documents, or managing back-and-forth payment commitments. These interactions still require human collectors to operate inside the inbox.

Because the solution is built around portal adoption and structured workflows, it is not purpose-built for that.

Sidetrade: Best for AI-Driven Collections Strategy & Credit Optimization

Sidetrade focuses on using AI agents to optimize collections strategy, credit decisions, and working-capital performance at scale. It is mainly designed for larger enterprises that want data-driven guidance on which accounts to prioritize, how to structure collection strategies, and how to improve cash outcomes across large portfolios.

The platform analyzes invoice data, payment behavior, customer segmentation, and historical outcomes to recommend optimal collection actions, credit limits, and dunning strategies.

However, Sidetrade does not automate two-way customer conversations inside the finance inbox. Customer emails, document requests, and dispute clarifications are still handled by collectors or via connected workflow tools.

Comparison of AR Automation Tools' Integration, Inbox Automation, and Deployment

This table compares leading AR automation platforms across key criteria, including the top platforms, target users, integration depth, inbox-level automation capabilities, and typical deployment timelines, helping finance teams identify the solution that best fits their operational needs.

| Platform | Best For | Integration Depth | Inbox Automation | Deployment Time |

|---|---|---|---|---|

| Paraglide (Best AI Agent for communication) | AR teams struggling under high-volume emails needing 2-way AI communication | ERP, Billing, CRM, multi-entity, multi-region | Strongest: AI handles entire email threads, detects intent, replies with context, retrieves documents, captures promise-to-pay, and escalates only when needed | Fastest: Get started in days not months |

| Versapay | Teams needing collaborative workflows | ERP & portal integrations | Portal reduces some emails, but not inbox automation | Moderate: Requires customer portal adoption |

| Gaviti | Mid-market focusing on dunning consistency | Basic ERP & billing integration | Basic automated reminders; no inbox-level AI | Simple, workflow-focused |

| Billtrust | Enterprise invoice-to-cash teams | ERP, Billing, CRM | Light, workflow-driven communication | Longer enterprise rollout |

| HighRadius | Global enterprises needing deep automation | ERP, Billing, CRM, predictive analytics | Automated emails + workflows, not built for inbox triage | Complex, structured enterprise deployment |

| Sidetrade | Teams needing AI-driven collections strategy | ERP, Billing, CRM | AI-driven collections strategy | Longer enterprise rollout |

Understanding these platforms' capabilities is important, but the real question for finance leaders is how to translate them into measurable outcomes. Let's see how AR automation directly reduces DSO by removing the delays, manual work, and communication gaps outlined above.

How AR Automation Software Reduces DSO (Without Adding Headcount)

Lowering DSOs is about removing the friction points that slow payments down in the first place. Current AR automation software helps finance teams shorten payment cycles by eliminating inbox bottlenecks, capturing clearer data, and keeping up consistent, structured follow-ups even when invoice volume increases.

Below are the key ways automation directly impacts DSO without requiring additional staff.

Significantly Lowering Delays Caused by Slow Responses

A significant portion of DSO comes from unanswered customer questions, which are missing invoices, wrong amounts, unclear PO references, or requests for supporting documents. Usually, traditional AR workflows rely on humans responding manually, which means replies often take hours or days.

Automation speeds up this cycle by sending documents instantly, routing queries to the right owner, and generating accurate replies based on ERP data. Platforms like Paraglide help maintain "conversation velocity" by handling routine questions in real time, stopping minor delays from turning into multi-week payment pushes.

Turning Email Conversations Into Data

Another common issue that most AR teams struggle with is that the details that determine payment timing, like promise-to-pay dates, disputes, approvals, and payment confirmations, live in the inbox instead of the ERP.

These AR automation tools change these conversations into structured data that can be tracked, analyzed, and used for forecasting. This also reduces the risk of missed follow-ups caused by fragmented communication.

Keep a Consistent Follow-Ups

Consistency is one of the strongest predictors of on-time payment, yet it's also one of the hardest behaviors to sustain manually. High invoice volumes make it nearly impossible for teams to follow up at the right intervals with the right tone. Automation solves this by supporting a structured, predictable follow-up pattern across every customer segment, even when teams are busy with month-end or escalations.

Tools that support two-way communication are high in demand because they go further by continuing the conversation automatically, sending clarifications, escalating appropriately, and keeping the payment process moving.

Improving Forecasting Accuracy With Real-Time Insights

Forecasting accuracy improves when finance teams can track customer intent. AR software incorporates signals such as reply speed, dispute volume, missing documentation, and stated payment dates to generate more realistic forecasts.

AI-driven tools like Paraglide increase this further by using communication data, including promise-to-pay commitments and unresolved questions, to update expected payment timelines in real time. This gives controllers and CFOs a clearer view of risk and expected cash flow without manual data gathering.

How to Implement AR Automation: A Practical 5-Step Roadmap

In my experience, most AR teams fail automations because they try to automate everything at once. A focused, phased approach lets finance teams prove value quickly, control risk, and build internal trust.

Below is a practical roadmap that aligns with how real AR departments operate. Let's get started:

Step 1: Identify a High-Pain, High-Volume Workflow

Start where your team feels the pressure the most. For most AR functions, this is the finance inbox, disputes, or payment follow-ups, the areas generating the most repetitive work and the highest delay risk.

These workflows also give the biggest early wins because they're directly tied to late payments, customer confusion, and DSO creep. Yes, CFO's have a broad vision, but Gartner reports that nearly 70% of change projects are moving more slowly than expected.

Step 2: Choose a Tool Matched to Your Workflow Volume

Selecting the right AR automation platform depends on the scale and type of workflow you're trying to improve. Mid-market teams managing high dispute volumes or customer collaboration needs tend to adopt tools like Versapay, which centralizes communication through a shared portal.

Enterprise organizations with multi-entity operations or complex cash application requirements lean toward platforms like Billtrust or HighRadius, which give deeper workflow automation, forecasting, and AI-driven matching.

Mid-market collections teams often prefer Gaviti for structured dunning sequences and analytics. And for teams whose biggest bottleneck is the finance inbox, where 60 - 80% of payment delays originate, platforms like Paraglide are built specifically to automate 2-way communication, document retrieval, and follow-ups at scale. Matching your workflow volume to the right tool category prevents overbuying, underbuying, and misalignment during implementation.

Step 3: Define Success Metrics (DSO, Resolution Time, Inbox Volume)

Clear KPIs stop "automation theatre", the tools added without meaningful impact. The most common metrics include:

- DSO reduction, for example, targeting a 5-15% improvement within a quarter.

- Case resolution time, especially for billing disputes and missing documentation

- Inbox volume reduction, measured as automated vs. human-handled messages

- Promise-to-pay accuracy, a leading indicator of actual cash flow

- % of customers receiving consistent follow-ups

Teams that place these metrics upfront are able to quantify ROI and prove value to CFOs and controllers.

Step 4: Run a Contained Pilot With a Human-in-the-Loop

Human-in-the-loop review builds trust with AR specialists and credit controllers. Leading companies like Microsoft and GE routinely follow this pattern when deploying workflow automation, starting with a supervised pilot before expanding.

A controlled rollout ensures the automation behaves as expected before scaling. You can segment the pilot by:

- a specific inbox segment, like missing invoice requests

- a customer cohort, one region, or business unit

- or an invoice threshold

Step 5: Scale Across Regions, Customer Segments & AR Tasks

Finally, once workflows are stable, automation can move upstream into more complex processes: multi-region collections, multi-currency customers, large strategic accounts, and dispute management.

Scaling progressively ensures governance, predictable outcomes, and cross-team alignment. It's almost 2026 and already most AR teams have eventually automated:

- Reminders across all segments

- Inbound email triage

- Document retrieval

- Multi-language communication

- Cash application inputs

This phased approach helps AR leaders reduce operational load while avoiding the typical pitfalls of "big bang" rollouts.

What is the Future of AR Automation?

The direction of AR is becoming clearer as manual follow-ups and disconnected systems simply won't scale. The tools that win will be the ones that reduce friction, shorten response cycles, and let teams operate with fewer bottlenecks and fewer surprises.

AI Agents Becoming Standard in Finance Workflows

From what I've seen, the volume of customer emails isn't going down, and most AR teams simply can't keep up without help.

That's why AI agents have become important in day-to-day finance work, not as a nice-to-have, but because teams need a way to handle the routine questions that slow everything else down.

Enterprise platforms like HighRadius and Billtrust are building more AI into their workflows, while inbox-based tools like Paraglide show that AI can sit directly in the finance inbox and manage the repetitive parts of communication. At this point, it's becoming clear that AI support will be standard.

Predictive Cash Flow & Auto-Risk Escalation

Cash flow forecasting has always been difficult when half the story lives inside scattered emails, spreadsheet notes, or someone's memory. The shift now is that automation tools are pulling this data together and using it for early warning signs, who's stalling, who's asking the same questions, and which accounts are trending late.

HighRadius already leans heavily into prediction at the enterprise level, and even mid-market tools like Gaviti are adding smarter prioritization. As more systems incorporate communication data, risk scoring, and escalation will become more realistic and far less manual.

Human + AI Collaboration Isn't a Replacement

Most finance teams I work with aren't trying to replace anyone; they're trying to keep up. Even with good systems in place, collectors still handle the judgment calls, the relationship-driven conversations, and the unusual disputes that don't follow a script.

Automation just removes the constant low-value work: chasing documents, answering the same questions, sending reminders, or trying to decide which customer to follow up with next. Tools like Versapay help keep conversations organized, enterprise systems handle the structured workflows, and inbox-level AI agents such as Paraglide take on the repetitive email tasks.

The pattern is consistent: AI picks up the busywork so people can focus on the parts of AR that actually require people.

Wrapping Up the Future of Accounts Receivable

What's becoming obvious is that accounts receivable software is shifting from systems of record to systems of action, tools that communicate, predict, and step in before problems grow. Whether it's enterprise platforms tightening workflows or inbox-native agents managing the communication load, the future leans heavily toward shared human-AI responsibility.

Now the real question I'd like to ask is, when your AR inbox hits 1000 unread emails, do you want more staff or a smarter AI assistant that keeps everything moving?

Frequently Asked Questions

Ready to Transform Your AR Process?

Discover how Paraglide's AI agents can reduce your DSO, automate repetitive tasks, and free your team to focus on strategic priorities.

Book a demo